In the world of investing, cheap and volatile stocks can be a double-edged sword. On one hand, they offer the potential for high returns. On the other hand, their price volatility can make them risky investments. In this article, we'll explore the ins and outs of cheap volatile US stocks, providing you with the knowledge to invest wisely.

Understanding Volatility

Firstly, let's clarify what we mean by "volatile." Volatility refers to the degree of price fluctuation in a stock. High-volatility stocks experience rapid and significant price changes, which can be both good and bad. When a stock is volatile, it can skyrocket, leading to substantial gains. Conversely, it can plummet, resulting in significant losses.

Identifying Cheap Stocks

So, what makes a stock "cheap"? Generally, cheap stocks are those trading at a low price relative to their fundamentals, such as earnings, book value, or cash flow. Investors often look for stocks with a price-to-earnings (P/E) ratio below the market average or a price-to-book (P/B) ratio lower than the industry.

The Risks and Rewards

Investing in cheap volatile US stocks comes with its own set of risks and rewards. Here's a closer look:

Risks:

Rewards:

Case Studies

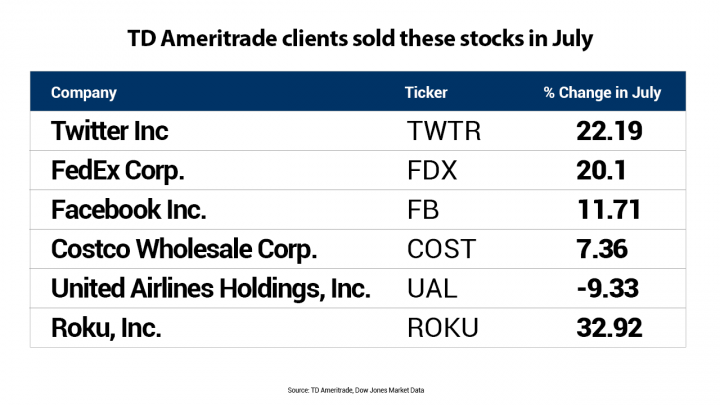

To illustrate the potential of cheap volatile US stocks, let's look at a few case studies:

How to Invest in Cheap Volatile US Stocks

To invest in cheap volatile US stocks, consider the following tips:

In conclusion, cheap volatile US stocks can be an exciting and potentially profitable investment. However, they also come with their own set of risks. By doing your research, managing risk, and staying informed, you can make wise investments in these types of stocks.

new york stock exchange