Investing in stocks has always been a popular choice for many Americans seeking financial growth and stability. However, the question of whether stock investing in the U.S. is reliable has been a topic of debate. In this article, we will explore the reliability of stock investing in the U.S., considering various factors that influence its performance.

Understanding the Stock Market

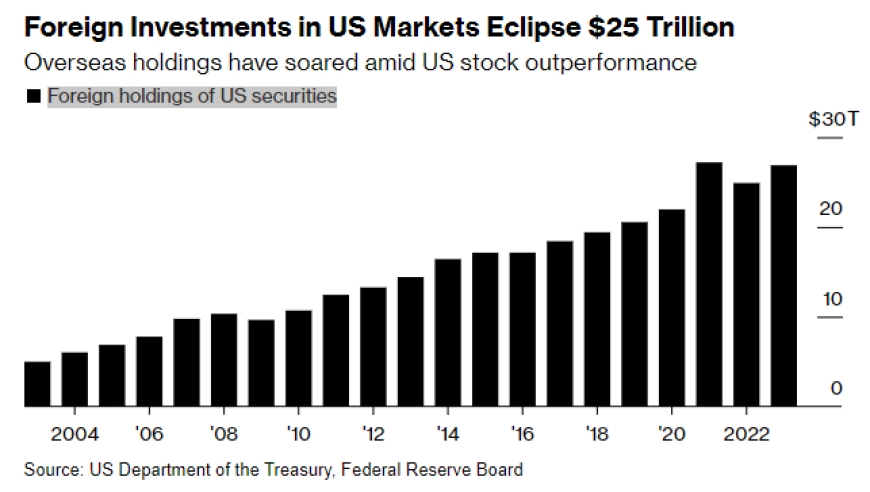

The stock market is a complex system where investors buy and sell shares of publicly traded companies. The U.S. stock market, particularly the New York Stock Exchange (NYSE) and the Nasdaq, is considered one of the most robust and liquid in the world. Historically, the U.S. stock market has shown consistent growth, making it an attractive investment option.

Factors Influencing Reliability

Several factors contribute to the reliability of stock investing in the U.S.:

Economic Stability: The U.S. has a strong economy, characterized by low inflation and high employment rates. This stability provides a favorable environment for companies to thrive, leading to potential stock price increases.

Regulatory Framework: The U.S. has stringent regulations that protect investors and ensure fair trading practices. Organizations like the Securities and Exchange Commission (SEC) monitor and enforce these regulations, enhancing the reliability of the stock market.

Market Liquidity: The U.S. stock market boasts high liquidity, making it easy for investors to buy and sell shares. This liquidity reduces the risk of large price fluctuations, contributing to the reliability of stock investing.

Dividends and Capital Gains: Many U.S. companies offer dividends and capital gains, providing investors with consistent income and potential profit. These factors make stock investing in the U.S. more reliable compared to other markets.

Challenges and Risks

Despite its reliability, stock investing in the U.S. is not without challenges and risks:

Market Volatility: The stock market is subject to volatility, with prices fluctuating rapidly. This volatility can lead to significant losses, especially if investors react impulsively.

Economic Uncertainty: Global economic events, such as political instability or pandemics, can impact the U.S. stock market. Investors need to be aware of these risks and adjust their portfolios accordingly.

Investment Knowledge: Successful stock investing requires knowledge and expertise. Investors who lack this knowledge may find it challenging to make informed decisions and mitigate risks.

Case Studies

To illustrate the reliability of stock investing in the U.S., let's consider two case studies:

Apple Inc.: Over the past decade, Apple's stock has experienced significant growth, outperforming the overall market. This growth can be attributed to the company's strong fundamentals, innovation, and market leadership.

Tesla Inc.: Tesla's stock has surged in recent years, driven by the company's innovative electric vehicles and global expansion. This example highlights the potential for high returns in the U.S. stock market.

Conclusion

In conclusion, stock investing in the U.S. can be a reliable investment option for those willing to invest time and effort into understanding the market. While it is not without risks, the U.S. stock market's stability, regulatory framework, and potential for growth make it an attractive choice for investors. As with any investment, it is crucial to do thorough research and seek professional advice to mitigate risks and maximize returns.

us energy stock