In the world of finance, the price-to-earnings (PE) ratio is a crucial metric that investors use to evaluate the value of stocks. The average PE ratio of US stocks can provide valuable insights into the market's overall health and potential future performance. In this article, we will delve into what the average PE ratio is, its significance, and how it can help investors make informed decisions.

What is the Average PE Ratio?

The PE ratio, also known as the price-to-earnings ratio, is a financial metric that compares the current market price of a stock to its per-share earnings. It is calculated by dividing the stock price by the earnings per share (EPS). The average PE ratio is the sum of all PE ratios in the market divided by the number of stocks.

For example, if the average PE ratio of US stocks is 20, it means that investors are willing to pay

Significance of the Average PE Ratio

The average PE ratio of US stocks can provide several insights:

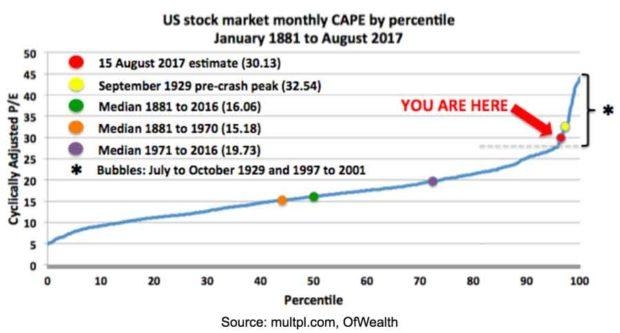

Market Valuation: A high average PE ratio suggests that the market is overvalued, which may indicate that stocks are expensive relative to their earnings. Conversely, a low average PE ratio indicates that the market is undervalued, potentially offering good buying opportunities.

Economic Conditions: The average PE ratio can reflect economic conditions. For instance, during periods of economic growth, companies tend to earn higher profits, leading to a higher PE ratio. Conversely, during economic downturns, earnings may decline, resulting in a lower PE ratio.

Sector Trends: The average PE ratio can also highlight sector trends. For example, technology stocks often have higher PE ratios compared to utilities or consumer goods companies.

Case Study: Tech Stocks and the PE Ratio

Let's take a look at the tech sector as a case study. In recent years, technology stocks have experienced significant growth, driving up their PE ratios. Companies like Apple and Microsoft, which dominate their respective markets, have PE ratios that are well above the average. This suggests that investors are willing to pay a premium for these stocks due to their strong earnings potential and market leadership.

However, this trend has raised concerns about overvaluation in the tech sector. Some investors argue that the high PE ratios may not be sustainable and that a market correction could occur if earnings growth slows down.

Conclusion

Understanding the average PE ratio of US stocks is essential for investors looking to gauge the market's valuation and identify potential opportunities. While a high PE ratio may indicate overvaluation, a low PE ratio may suggest undervaluation. By analyzing the average PE ratio and considering economic conditions and sector trends, investors can make more informed decisions about their investments.

us stock market live