In the vast sea of investment options, small US company stocks often fly under the radar. However, these stocks can be a goldmine for investors looking to capitalize on significant growth potential. This article delves into the world of small US company stocks, highlighting their unique advantages and providing insights into how you can identify and invest in these lucrative opportunities.

Understanding Small US Company Stocks

Small US company stocks refer to shares of publicly traded companies with a relatively low market capitalization. Typically, these companies have a market cap of less than $2 billion. While they may not be as well-known as larger corporations, they often offer higher growth prospects and potentially greater returns.

Advantages of Investing in Small US Company Stocks

Higher Growth Potential: Small companies often experience rapid growth as they expand their market presence and develop new products or services. This can lead to significant increases in share prices.

Attractive Valuations: Small US company stocks are often undervalued compared to larger companies in the same industry. This provides investors with an opportunity to purchase shares at a lower price and benefit from future growth.

Diversification: Investing in small US company stocks can help diversify your portfolio, reducing the risk associated with investing in a single stock or industry.

Access to Emerging Markets: Small companies often operate in emerging markets or niche industries, providing investors with exposure to high-growth sectors.

How to Identify Small US Company Stocks

Research: Conduct thorough research on potential investments. Look for companies with strong fundamentals, such as a solid revenue growth rate, low debt levels, and a skilled management team.

Market Capitalization: Focus on companies with a market cap of less than $2 billion. This will help narrow down your search to small US company stocks.

Industry Analysis: Analyze the industry in which the company operates. Look for industries with strong growth potential and a favorable outlook.

Financial Ratios: Evaluate financial ratios such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and return on equity (ROE) to assess the company's financial health.

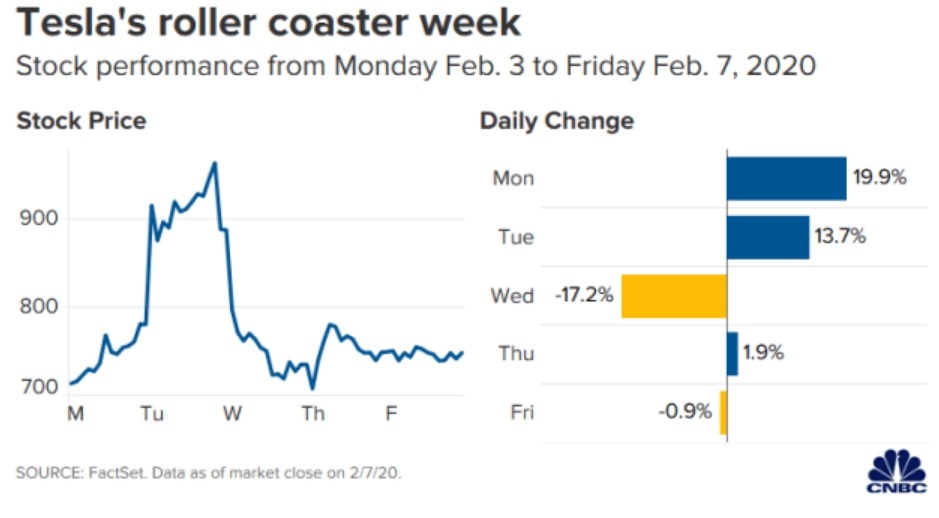

Case Study: Tesla, Inc.

A prime example of a small US company stock that turned into a massive success is Tesla, Inc. When it went public in 2010, Tesla had a market cap of just

Conclusion

Small US company stocks can be a lucrative investment opportunity for those willing to do their homework and take calculated risks. By focusing on companies with strong fundamentals, attractive valuations, and high growth potential, investors can capitalize on the unique advantages of small US company stocks. Remember to conduct thorough research and diversify your portfolio to mitigate risk.

can foreigners buy us stocks