Investing in stocks can be a lucrative endeavor, but it's essential to approach it with a strategic mindset. Picking the right stocks is key to achieving long-term financial success. Whether you're a beginner or an experienced investor, this comprehensive guide will provide you with essential tips and strategies for selecting US stocks.

Understanding the Market

Before diving into the world of stock picking, it's crucial to have a basic understanding of the stock market. The US stock market is the largest and most developed in the world, offering a wide range of investment opportunities across various sectors and industries.

Research and Analyze

The foundation of successful stock picking lies in thorough research and analysis. Here are some key steps to consider:

Identify Your Investment Goals: Determine what you want to achieve with your investments. Are you looking for long-term growth, income, or a mix of both?

Understand the Sectors: Familiarize yourself with different sectors, such as technology, healthcare, finance, and consumer goods. Each sector has its unique characteristics and risks.

Analyze Financial Statements: Examine a company's financial statements, including the balance sheet, income statement, and cash flow statement. Look for consistent revenue growth, strong profitability, and healthy cash flow.

Evaluating Valuation Metrics: Assess the company's valuation using metrics like price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and enterprise value-to-EBITDA (EV/EBITDA) ratio. Compare these metrics to industry averages and historical data.

Consider Fundamental Analysis: Look beyond financial metrics and analyze the company's business model, management team, and competitive advantages. A solid business model and an experienced management team can significantly impact a company's long-term success.

Technical Analysis

While fundamental analysis focuses on a company's financial health, technical analysis involves analyzing stock price movements and patterns. Here's how to incorporate technical analysis into your stock-picking strategy:

Identify Trends: Study historical price charts to identify trends. Uptrend, downtrend, and sideways trends are common patterns to consider.

Use Indicators: Technical indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands, can help identify potential entry and exit points.

Volume Analysis: Analyze trading volume to confirm trends. High volume during a trend indicates strong participation and potential continuation of the trend.

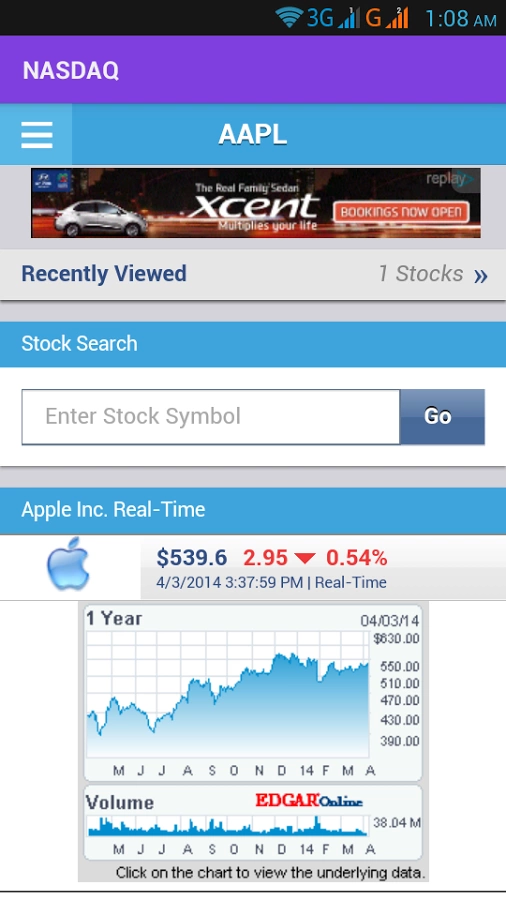

Case Study: Apple Inc. (AAPL)

Let's take a look at a real-world example. Apple Inc. (AAPL) is a leading technology company known for its innovative products and strong financial performance.

Fundamental Analysis:

Technical Analysis:

By combining both fundamental and technical analysis, investors can make informed decisions about whether to invest in Apple Inc.

Risk Management

It's crucial to manage your risk when picking stocks. Here are some key risk management strategies:

Diversify Your Portfolio: Invest in a variety of stocks across different sectors and industries to minimize the impact of a single stock's poor performance.

Set Stop-Loss Orders: Protect your investments by setting stop-loss orders at a predetermined price point. This will help limit your losses in case the stock price falls.

Stay Informed: Keep up-to-date with market news and company developments. This will help you make informed decisions and adjust your portfolio as needed.

In conclusion, picking US stocks requires a combination of research, analysis, and risk management. By following the strategies outlined in this guide, you can increase your chances of success in the stock market. Remember, investing is a long-term endeavor, and patience and discipline are key to achieving your financial goals.

new york stock exchange