In today's volatile financial markets, investing in commodity stocks can be a strategic move for investors seeking diversification and potential growth. US commodity stocks refer to publicly traded companies involved in the exploration, production, processing, and distribution of commodities such as oil, gas, gold, silver, agricultural products, and more. This article explores the key aspects of investing in US commodity stocks, including their benefits, risks, and potential opportunities.

Understanding US Commodity Stocks

Commodity stocks are shares of companies that are directly or indirectly involved in the production and distribution of raw materials. These stocks are often associated with high volatility, as the prices of commodities can fluctuate significantly due to various factors such as supply and demand, geopolitical events, and market speculation.

Investing in US commodity stocks can offer several benefits:

Risks Associated with US Commodity Stocks

Despite the potential benefits, investing in US commodity stocks also comes with its own set of risks:

Key Factors to Consider When Investing in US Commodity Stocks

When considering investing in US commodity stocks, it's essential to research and analyze several key factors:

Case Studies: Successful Investments in US Commodity Stocks

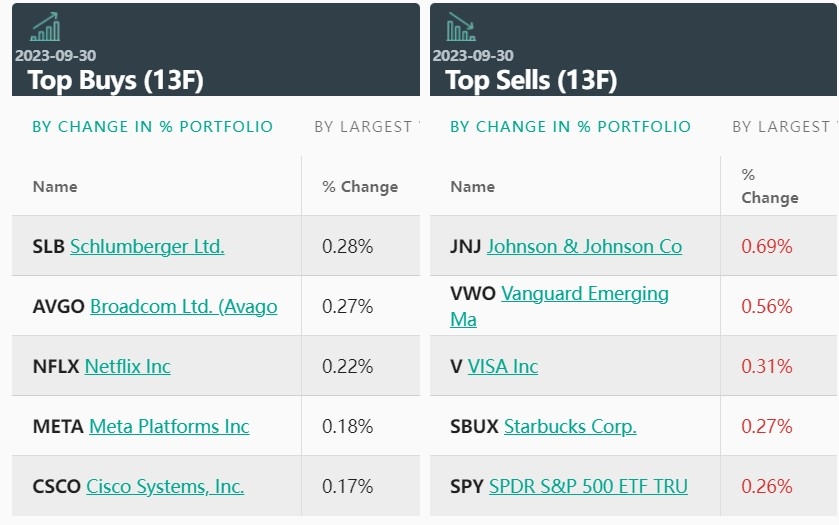

One notable example of a successful investment in US commodity stocks is the investment in Schlumberger (SLB), a leading oilfield services company. Over the past decade, Schlumberger has consistently outperformed the market, driven by the rising demand for energy and the company's innovative technologies.

Another example is the investment in Gold Fields (GFI), a leading gold producer. Gold has historically been seen as a safe haven asset, and Gold Fields has provided investors with significant returns over the years, particularly during periods of economic uncertainty.

Conclusion

Investing in US commodity stocks can be a strategic move for investors seeking diversification and potential growth. However, it's essential to conduct thorough research and understand the associated risks before making investment decisions. By analyzing key factors such as commodity price trends, company financials, and market position, investors can make informed decisions and potentially benefit from the dynamic nature of the commodity market.

new york stock exchange