In the complex world of financial reporting, understanding the nuances of accounting standards is crucial for businesses and investors alike. One such area is the treatment of deferred tax assets for stock options under the United States Generally Accepted Accounting Principles (US GAAP). This article aims to provide a comprehensive overview of this topic, including its significance, accounting treatment, and practical examples.

What is a Deferred Tax Asset?

A deferred tax asset (DTA) is an asset that arises from temporary differences between the financial accounting and tax bases of assets and liabilities. These temporary differences can occur due to various reasons, such as different depreciation methods, timing differences in revenue recognition, or tax credits. In the context of stock options, a DTA arises when the tax cost of the options is less than their accounting cost.

Stock Options and Deferred Tax Assets

Stock options are a form of employee compensation that gives employees the right to purchase company shares at a predetermined price. While stock options can be a valuable tool for attracting and retaining talent, they also have accounting implications. Under US GAAP, the cost of stock options is recognized as an expense over the employee's service period, typically vesting period.

However, for tax purposes, the cost of stock options is generally deductible when the options are exercised. This creates a temporary difference, resulting in a deferred tax asset. The DTA represents the future tax benefit that the company will realize when the temporary difference reverses.

Accounting Treatment of Deferred Tax Assets for Stock Options

The accounting treatment of deferred tax assets for stock options is governed by ASC 718-20, Compensation – Stock Compensation. According to this standard, a company must recognize a deferred tax asset when the tax cost of the options is less than their accounting cost. The amount of the DTA is determined by multiplying the difference between the tax cost and accounting cost of the options by the applicable tax rate.

For example, let's consider a company that grants stock options to its employees at a strike price of

In this scenario, the temporary difference is

Case Studies

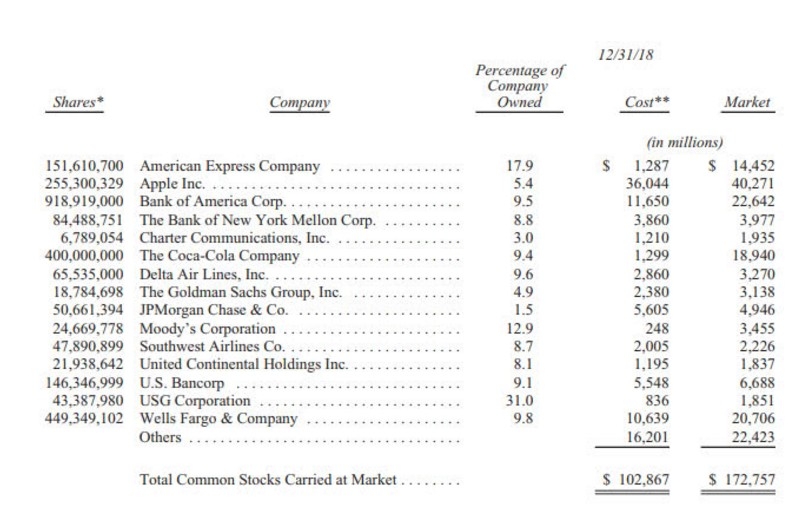

Several companies have successfully utilized deferred tax assets for stock options to enhance their financial position. One notable example is Apple Inc. In its 2019 annual report, Apple disclosed a deferred tax asset of $57.6 billion, primarily related to stock-based compensation. This DTA helped offset the company's income tax expense, resulting in a lower effective tax rate.

Conclusion

Understanding deferred tax assets for stock options under US GAAP is essential for businesses to accurately report their financial performance. By recognizing these assets, companies can reflect the future tax benefits associated with their stock options. As the accounting landscape continues to evolve, staying informed about these complexities is crucial for maintaining compliance and making informed financial decisions.

us energy stock