Introduction

Investing in US stocks from Australia can be an exciting opportunity for investors looking to diversify their portfolios and take advantage of the world's largest stock market. With the rise of online trading platforms and the ease of accessing international markets, investing in US stocks from Australia has become more accessible than ever. In this article, we'll guide you through the process of investing in US stocks from Australia, including the key steps and considerations you need to keep in mind.

Choosing a Broker

The first step in investing in US stocks from Australia is to choose a reliable and reputable broker. There are several brokers that offer services for international investors, and it's important to do your research and compare their fees, platform features, and customer service. Some popular brokers for Australian investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Understanding the US Stock Market

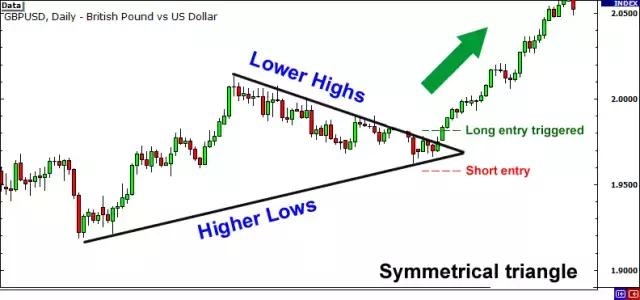

Before you start investing, it's crucial to have a good understanding of the US stock market. The US stock market is made up of several exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. Each exchange has its own set of rules and regulations, and it's important to familiarize yourself with these to ensure you're making informed investment decisions.

Opening an Account

Once you've chosen a broker, the next step is to open an account. This process typically involves filling out an application form, providing your personal and financial information, and verifying your identity. Some brokers may also require you to link your bank account to your trading account for funds transfer.

Transferring Funds

After your account is set up, you'll need to transfer funds from your Australian bank account to your US brokerage account. This can be done through wire transfer or other electronic payment methods. It's important to note that there may be fees associated with transferring funds, so be sure to factor this into your investment strategy.

Picking Stocks

Once you have funds in your US brokerage account, you can start picking stocks. There are several ways to do this, including:

Monitoring Your Investments

After you've made your investments, it's important to monitor them regularly. This involves reviewing your portfolio's performance, staying informed about market news and developments, and adjusting your investments as needed. Some brokers offer tools and resources to help you monitor your investments, such as real-time quotes, charting tools, and portfolio tracking.

Case Study: ABC Corp

Let's say you're interested in investing in ABC Corp, a US technology company. After conducting thorough research, you determine that the company has a strong track record of growth and a solid financial position. You decide to invest $10,000 in ABC Corp shares through your US brokerage account.

Over the next few months, you keep a close eye on the stock's performance and market news. You notice that the company is launching a new product that is generating a lot of buzz in the industry. As a result, the stock price starts to rise, and your investment grows in value.

Conclusion

Investing in US stocks from Australia can be a rewarding experience for investors looking to diversify their portfolios and take advantage of the world's largest stock market. By following these steps and doing your research, you can make informed investment decisions and potentially achieve significant returns.

us stock market live