In the ever-evolving world of finance, the volume of trading on the US stock exchanges is a critical indicator of market activity and investor sentiment. This article delves into the significance of US stock exchange volumes, examining what they represent and how they impact the broader market. By understanding these dynamics, investors can gain valuable insights into market trends and make informed decisions.

What Are US Stock Exchange Volumes?

US stock exchange volumes refer to the total number of shares traded on the major stock exchanges in the United States, such as the New York Stock Exchange (NYSE) and the NASDAQ. These volumes are typically measured in terms of the number of shares traded per day or per month. By analyzing these figures, investors and analysts can gauge the level of market activity and identify potential trends.

Why Are US Stock Exchange Volumes Important?

1. Market Activity: High trading volumes indicate a high level of market activity, which can be a sign of strong investor confidence. Conversely, low trading volumes may suggest a lack of interest or uncertainty in the market.

2. Price Movements: Trading volumes can influence price movements. For example, a significant increase in trading volume may lead to higher prices, while a decrease in volume may result in lower prices.

3. Market Trends: By analyzing long-term trends in trading volumes, investors can identify potential market trends and make informed investment decisions.

4. Economic Indicators: US stock exchange volumes are often used as economic indicators, providing insights into the overall health of the economy.

Analyzing US Stock Exchange Volumes

To analyze US stock exchange volumes, investors can consider several key factors:

1. Historical Data: Comparing current trading volumes to historical data can help identify trends and patterns.

2. Market Sectors: Analyzing trading volumes across different market sectors can provide insights into which sectors are performing well or poorly.

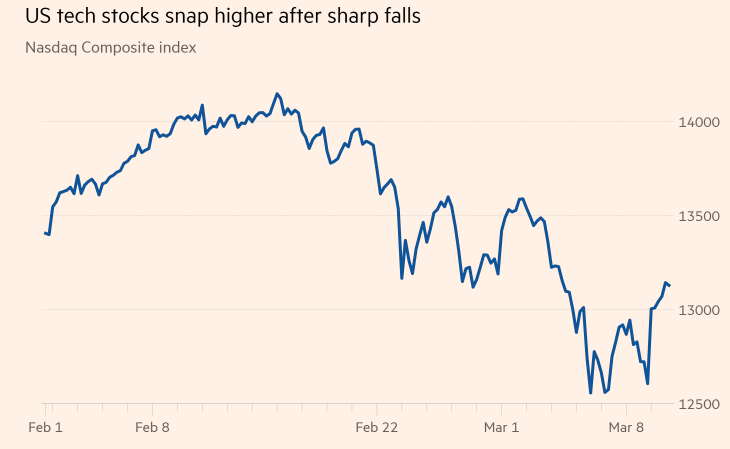

3. Market Indices: Tracking trading volumes for major market indices, such as the S&P 500 or the NASDAQ Composite, can help gauge overall market sentiment.

4. Economic News and Events: Keeping an eye on economic news and events can help investors anticipate changes in trading volumes.

Case Study: The 2020 Stock Market Crash

One notable example of how US stock exchange volumes can impact the market is the 2020 stock market crash. In February and March 2020, trading volumes surged as investors reacted to the COVID-19 pandemic. This surge in volume was a direct result of the increased uncertainty and volatility in the market. By analyzing these trading volumes, investors were able to identify the severity of the market downturn and adjust their portfolios accordingly.

Conclusion

Understanding US stock exchange volumes is crucial for investors looking to gain insights into market activity and trends. By analyzing trading volumes, investors can make informed decisions and stay ahead of the market. Whether you're a seasoned investor or just starting out, keeping an eye on US stock exchange volumes can provide valuable insights into the broader market and help you navigate the complexities of the financial world.

us stock market today