In recent years, the United States has faced a tumultuous period characterized by fluctuating inflation rates and volatile stock market performances. This article aims to delve into the interplay between these two economic phenomena, highlighting their impacts on the broader economy and investors alike.

Understanding Inflation

Firstly, it's essential to understand what inflation is. Inflation refers to the general increase in prices of goods and services over time. When inflation rises, the purchasing power of money decreases, meaning that each dollar buys fewer goods and services than before.

Inflation's Effects on the Stock Market

Historically, there has been a significant relationship between inflation and the stock market. High inflation can lead to a number of negative consequences for stocks:

Stock Market Performance Amidst Inflation

Despite these challenges, the stock market has often shown resilience amidst high inflation. Historical cases include:

Recent Developments

In recent years, the US has experienced transitory inflation, a term used by the Federal Reserve to describe inflation that is expected to be temporary. However, this has raised concerns about its potential to become more persistent.

Investor Strategies

For investors navigating the inflationary environment, there are several strategies to consider:

In conclusion, the relationship between US inflation and the stock market is complex. While high inflation can pose challenges, the stock market has often shown resilience amidst these conditions. By understanding the dynamics of inflation and implementing sound investment strategies, investors can navigate this challenging environment more effectively.

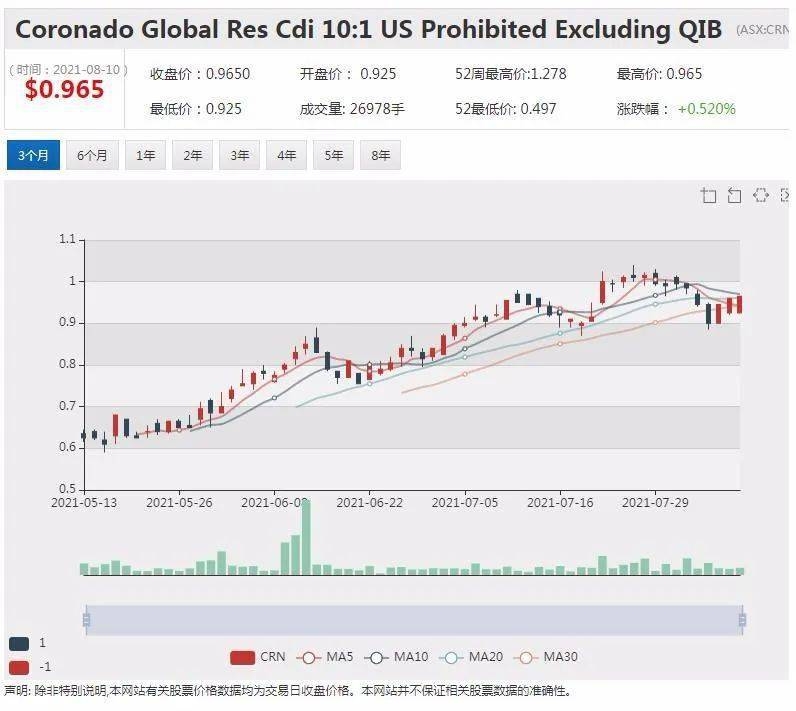

us stock market today live cha